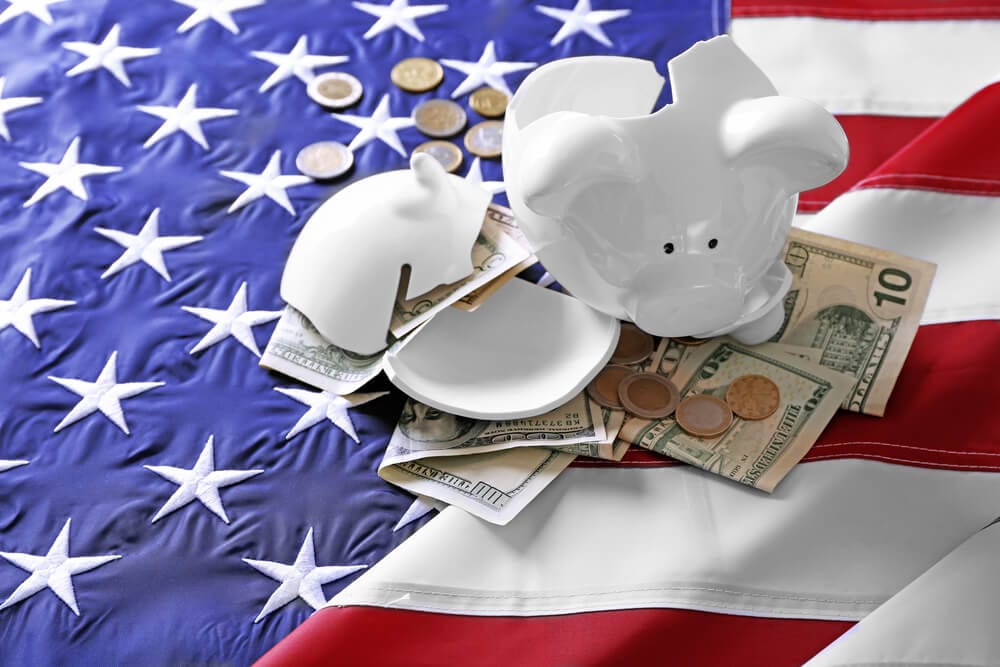

Bankruptcy Rates by Race in Financial Distress Across the United States.

Although bankruptcy is sometimes viewed as a final option for people who are overburdened by debt, not all areas are equally impacted. Data shows considerable racial differences in bankruptcy rates in the US, underscoring more profound structural and socioeconomic injustices.

In addition to illuminating the financial strains experienced by various racial groups, an understanding of bankruptcy trends by race also aids in identifying the structural obstacles that support these disparities.

This article looks at the racial differences in bankruptcy rates, investigates the underlying causes, and talks about the implications of these patterns for economic equity in the United States.

Get a quote from experts today

Bankruptcy Rates by Race in Financial Distress Across the United States

Direct comparisons based on racial identity are not feasible because bankruptcy filings do not document a filer’s race. However, many approaches to studying discrepancies have been established by scholars. One prominent 2017 ProPublica study found that, after controlling for population, people in mostly Black ZIP codes were more likely to file for bankruptcy than people in predominantly white ZIP codes. Significant differences in the types of bankruptcy filed and the success rates among various racial groups were also discovered by the study; these findings were supported by later research.

What Scientists Have Found

ProPublica compared majority-Black communities with majority-White, non-Hispanic areas by analyzing aggregated data by ZIP code in order to investigate racial tendencies. They paid particular attention to bankruptcies filed under Chapters 7 and 13. Black communities had a significantly higher number of Chapter 13 filings than White neighborhoods.

Success rates differed significantly: 58% of registrants in White ZIP codes completed Chapter 13 repayment plans, whereas only 39% of filers in Black ZIP codes did so. This pattern was confirmed by a 2023 follow-up study, which found that Black filers had a 16 percentage point higher chance of having their bankruptcy dismissed without debt relief in Chapter 13 cases and a 3 point higher chance in Chapter 7 cases.

An explanation of individual bankruptcy options

Chapter 7 and Chapter 13 are the two most popular bankruptcy filing options for people.

In Chapter 7, non-exempt assets are liquidated by a trustee appointed by the court. The funds are used to settle outstanding qualified debts and pay creditors. Certain commitments cannot be canceled, including child support, alimony, and certain taxes. Although these exemptions differ from state to state, they usually protect common assets like apparel, household goods, and the basic equity in a home or vehicle.

Often referred to as “reorganization” or a “wage earner’s plan,” Chapter 13 permits debtors to retain their assets while repaying creditors over a three to five-year period using a structured, court-approved repayment plan. Reclassification to Chapter 7 and subsequent asset liquidation could follow noncompliance.

Why Black Communities Frequently Use Chapter 13

Despite being intended to protect assets such as homes and cars, Chapter 13’s acceptance in ZIP areas with a predominantly Black population is complicated. Generally speaking, Black Americans are less likely than White Americans to be homeowners. According to ProPublica’s investigation, the discrepancy is caused by variations in upfront expenses. Legal fees for Chapter 7 are typically $1,000 and must be paid at the time of filing or soon after. Many law firms, on the other hand, permit Chapter 13 applications with no upfront payment and spread out the fees ($3,000–$4,000 total) over the repayment schedule.

Black filers in low-income areas might not have the money to file under Chapter 7, but Chapter 13 is a more accessible alternative because it does not need a deposit. Furthermore, in certain jurisdictions, unpaid court fines, such parking and traffic citations, may lead to license suspension or the confiscation of a vehicle. In areas with little public transportation, Chapter 13 can stop these proceedings and restore access to vehicles and driver’s licenses, which are necessary assets for everyday living and employment.

For example, a 2020 study found that Chapter 13 filings were particularly prevalent in Black communities in Chicago, where a large number of people depend on their cars to meet their fundamental requirements. In addition to restructuring debt, Chapter 13 allowed them to regain seized assets, which was not possible under Chapter 7, according to the report.

Recognizing the Sources of the Data

ProPublica focused on consumer cases filed between 2008 and 2015 and examined extensive bankruptcy records from the Administrative Office of U.S. Courts. In order to assess results across a complete five-year repayment period under Chapter 13, the comparison focused on filings made between 2008 and 2010.

Additional Bankruptcy Chapters and the Preservation of Assets

Individuals may file under Chapter 11 when Chapter 13 is not a possibility, usually because of debt or income that exceeds Chapter 13 limits, even though Chapter 11 is mainly utilized for corporate reorganizations.

As far as asset retention goes, Chapter 13 frequently let people to keep their cars as long as they adhere to the payments schedule. Depending on state exemptions, Chapter 7 may also allow the retention of a car or at least some of its equity. People may also choose to redeem their loan by paying it off in full in order to keep their assets, or they may choose to reaffirm the debt and keep making payments.

Broader socioeconomic gaps are highlighted by the racial disparity in bankruptcy filings, bankruptcy chapter selection, and discharge outcomes. The incidence of Chapter 13 in ZIP codes with a majority of Black residents is a reflection of wealth inequality, a lack of initial capital, and the need to maintain assets such as driver’s licenses and cars. These trends demonstrate how race, legal tactics, and financial resources interact in the US bankruptcy system. These findings highlight systemic injustices that impact vulnerable communities’ access to debt relief, even though additional study is required.

Conclusion

More than simply a financial figure, bankruptcy is a reflection of larger social issues that disproportionately impact communities of color. Although individual decisions and financial practices are important, historical inequities in wealth, income, credit availability, and job prospects are directly linked to racial differences in bankruptcy rates. More than just financial literacy is needed to address these problems; systemic change, focused assistance, and deliberate policy reforms are needed.

We make a significant step toward creating a more inclusive and equitable financial future for everybody by identifying and comprehending these racial trends in bankruptcy.